Selling is not a Backup Plan

Selling a company is a hard process, with a low likelihood of success.

If you liked reading this, please click the ❤️ button on this post so more people can discover it on Substack. Thanks!

No business lasts forever. Even if your business is doing well today, tomorrow can bring new competitors, new market conditions and other impossible challenges. Making more money than it costs to operate is a difficult balance, and even harder to maintain. Even with investors and capital, money runs out.

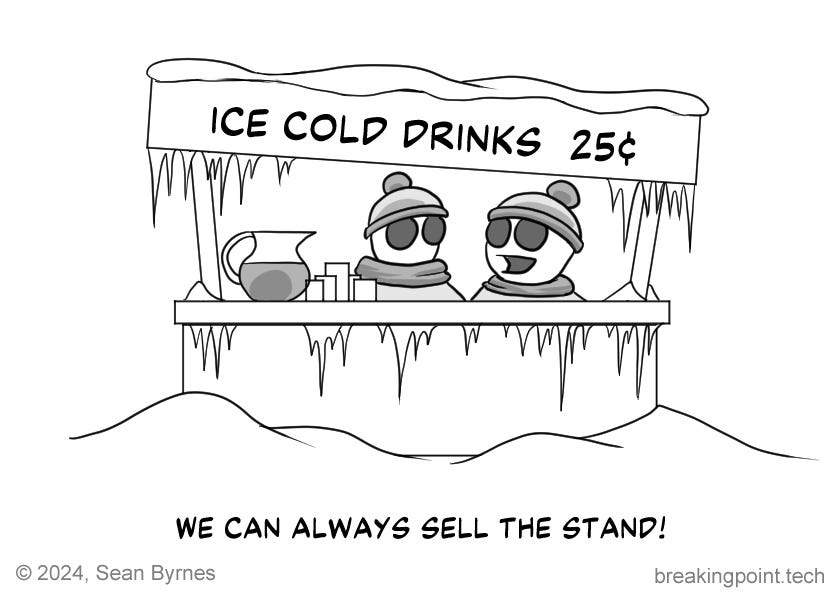

When things get difficult and failure seems like a likely outcome, I often hear CEOs say that “we can always sell the company.” If you’ve never tried to sell a company before, it can seem like there is always a market for good teams and good products. However, I’m sorry to say that is not true.

In order to sell your company, you need:

A buyer who needs your team, or product, or customers or all of the above.

A buyer who is interested in doing an acquisition right now.

A buyer who is willing to pay a price you would accept.

An executive at that buyer who is willing to bet their career on the acquisition.

That seems like a lot! Those factors rarely line up neatly, and when you look at the statistics that is why it’s so rare that companies are acquired.

In fact, the most likely outcome for a company that is struggling is to wind down. That might mean liquidation, bankruptcy or other structures. Sometimes it means just shutting everything down. That is the backup plan, and it’s always the default.

This doesn’t mean getting acquired is impossible, or that you can’t make it an option! You absolutely should invest the time to build relationships with the CEOs of potential acquirers years before you might need them. I used to have regular lunches with 4 or 5 of these kinds of CEOs every year. Not too often, but often enough that if I decided to sell I could call up someone who already knew our business and was likely to be interested.

But, that doesn’t make selling a backup option. It means selling is a potential option that, if you invest a lot of time and effort, might become a real option.

In technology there are “acqui-hires”, where an acquirer just hires the team and calls it an acquisition. These aren’t really acquisitions, as your company gets no compensation for it and all that happens is your team gets new jobs. However, it’s only a backup plan for you as an individual and not for the business. Even then, acqui-hires happen in hot labor markets and in the current environment not as much.

If your company is struggling and you think you need options, invest the time and effort to see if an acquisition is a possibility. Don’t treat it like a backup plan, treat it like a strategic priority that will take months/quarters to evaluate.

For more on Strategy, see:

Build a better product …

Companies get bought not sold

Like having a child, it’s not exactly what you thought it would be