One of the great (but obvious) challenges of making strategic business decisions is that it’s impossible to know exactly what will happen in the future. If you were playing chess, it’s possible (but hard) to understand all the possible outcomes of every move you make. In business, there are far too many variables and unknowns for you to even start to understand those future outcomes. Instead, you need to make decisions with insufficient information and a hazy understanding of the future.

I think we can agree that leadership is not easy.

When you’re facing very significant decisions, because of those unknowns, no matter what you decide you are taking a risk. Many of these decisions come down to what kind of risks you prefer to take, or which risks you can more easily handle. Choosing your risks is the only real form of control you have in most situations.

There are a near infinite number of risks you can have in business, but they generally fall into a few categories. Here are some common ones:

Market Risk. Stock markets go up, stock markets go down. Customers save, customers spend. Whether we are talking about the overall economy or just your specific market segment, these markets move in massive ways just like the tides moving boats. Often it’s impossible to predict how it will move and we are faced with reacting to changes when they happen.

Competitive Risk. Your competition has their own set of strategies and decisions, and there is always a risk they will affect you. Maybe the competition drops their price, or maybe they launch a new product, or maybe they poach one of your biggest customers. Competitive risk is hard because you know there are smart, motivated people out to beat you and given the chance they will.

Technical Risk. If you are building a new product, or upgrading an existing product, there is always a risk it won’t work. With companies pioneering entirely new technologies this is understandable as no one might have done it before. But even established product categories have technical risk since it’s possible you might not be able to get it to work, even if others do. The world is full of failed products in categories where there are successful products.

Team Risk. Businesses are made of people, and those people pose a risk. The most common kind of Team Risk is that key people will leave at the worst possible moment. For example, your key sales executive might leave before closing a huge deal that would make or break your year. Your team might lack the experience to navigate certain problems well. There are lots of risks that fall on your team, since people are complex.

Capital Risk. Businesses require capital, and there can be risk that you will run out of money. This is more typical of startup companies that raise VC funding (since they are always burning capital), but all businesses have risks of running out of capital. These are dangerous since there is very little you can do if you run out of capital, so you need to identify this risk very early.

Execution Risk. Running a business is hard, and even with a perfect strategy you might make mistakes. In fact, it’s guaranteed that you will! Whether those mistakes hinder the business or not is execution risk, which is a risk that you don’t run the business well enough. It’s the most sobering kind of risk, because you have no one to blame but yourself if the risk becomes reality.

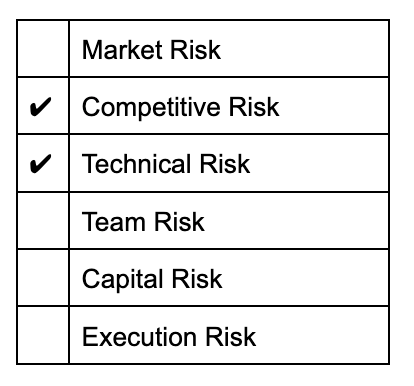

There are, of course, risks that don’t fall into these categories! There are so many types of risk that I find it useful to group them into two categories: risk you control and risk you don’t. Technical Risk, Capital Risk and Execution Risk are all types of risk based on actions you take. The risk, in these cases, is that you mess things up. But at least that is something you control!

Market Risk, Competitive Risk and Team Risk are risks that happen to you. You have no control over whether the market crashes, your competitors cut their prices or key members of your team resign. In fact, with these kinds of risks you’re a spectator more than a participant.

I don’t know about you, but I prefer to take risks where I have control. I don’t like my future relying on something else happening to me, so I always choose risks like Technical Risk, Capital Risk and Execution Risk when I have a choice. It turns out, in most decisions, you do have a choice!

Let me show you what I mean…

Making Risky Decisions

Let’s say that we’re the leadership team of a company, providing logistics software to the custom furniture industry. It’s a profitable business, but not a huge market, and there are 4-5 different companies that compete with us. The market doesn’t move very quickly, and while our business makes $4-5M in revenue each year, we haven’t changed how we work in many years.

The market has evolved, and it’s clear we need to upgrade our software to better integrate with platforms like Shopify if we want to stay in business. At the same time, we’ve been approached by one of our competitors to merge together and try to become the leader in this market. We have to choose: do we stay independent and rebuild our software or do we merge?

These decisions are hard, because there are so many unknowns, so let’s look at it through the lens of risk. Each of the options carry a very different risk profile:

Option 1: Stay Independent

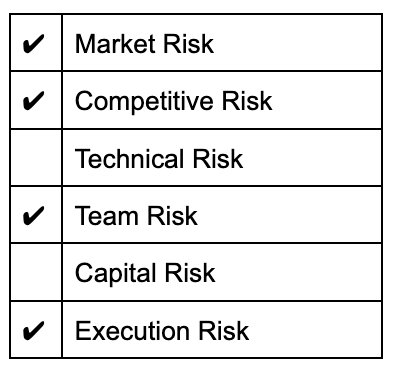

If we stay independent, we have Technical Risk in trying to rebuild our software since the project might fail. We also know that a competitor is pursuing a merger so if we pass they are likely to merge with someone else, creating Competitive Risk.

Option 2: Merge with Competitor

If we merge with a competitor, we have team risk since we are likely to lose some of our key people. We also rely on the quality of the people at the competitor, which might not be as high as ours (hence the Execution Risk). There is also the chance that the merger does not make us the leader, which is both Market and Competitive Risk.

Between the two, I would choose to stay independent since the Technical Risk is within our control. The competitive risk of Option 1 is real, but even if we pursue the merger that risk still exists. On the other hand, Option 2 has lots of risks we can’t control.

You can use a similar scorecard system for your hard decisions. These kinds of risk profiles can make otherwise difficult decisions much easier to understand.

Risky Business

While risk profiles can help you make decisions, you also need to be wary of risk avoidance. Many of us have made mistakes or had businesses fail due to one kind of risk or another. If you’ve ever had a company run out of money, you probably live in fear of Capital Risk no matter how well your company is doing. As a result, you do whatever you can to avoid Capital Risk.

Risk avoidance is very hard to detect, because it FEELS like experience or wisdom to you. You learned a lesson in the past, and you’re applying it to the present! Isn’t that learning? No, because the situation is likely very different. The pain you feel from before is clouding your judgment and preventing you from evaluating the risks appropriately.

Unfortunately, risk avoidance rarely leads to great decisions. If you can’t approach a decision objectively, you cannot make the right decision for that situation. Surrounding yourself with great teams, advisors and mentors can help identify these risk avoidance blind spots before you make bad decisions. Get input on key decisions from people you trust!

Final Word

There is no reward in business without taking risks, so we live with risks everyday. What risks you are willing to take determines your leadership style, your business operations and eventually the success (or failure) of your business.

While you can never know what the future holds, you can know what risks you are taking so spend the time to do just that. If you don’t, then you are taking risks blindly and we have a word for that: gambling.

The Breaking Point will be off for the rest of the year, see you in 2023!